Europen Elektronic Bill

Europen Elektronic Bill

hi,

in Europa i need, for B2B Business, to create a Bill which a Human and a Machine can read.

i need to create a PDF/A include XML File (EN 16931)

how to insert XML File into existing PDF/A File ?

how to read XML File inside PDF/A ?

in Europa i need, for B2B Business, to create a Bill which a Human and a Machine can read.

i need to create a PDF/A include XML File (EN 16931)

how to insert XML File into existing PDF/A File ?

how to read XML File inside PDF/A ?

greeting,

Jimmy

Jimmy

Re: Europen Elektronic Bill

Dear Jimmy,

can you post some basic information here?

Do you possibly have the legal basis?

How should the XML be structured?

It will probably be the same here in Austria or the EU regulation is already in force.

Kind regards,

Otto

can you post some basic information here?

Do you possibly have the legal basis?

How should the XML be structured?

It will probably be the same here in Austria or the EU regulation is already in force.

Kind regards,

Otto

********************************************************************

mod harbour - Vamos a la conquista de la Web

modharbour.org

https://www.facebook.com/groups/modharbour.club

********************************************************************

mod harbour - Vamos a la conquista de la Web

modharbour.org

https://www.facebook.com/groups/modharbour.club

********************************************************************

- Antonio Linares

- Site Admin

- Posts: 42268

- Joined: Thu Oct 06, 2005 5:47 pm

- Location: Spain

- Contact:

Re: Europen Elektronic Bill

Claude provides very complete info about it and code examples using Java and Python too:

https://claude.site/artifacts/7e0de32f- ... d38184db33

https://claude.site/artifacts/7e0de32f- ... d38184db33

- Antonio Linares

- Site Admin

- Posts: 42268

- Joined: Thu Oct 06, 2005 5:47 pm

- Location: Spain

- Contact:

Re: Europen Elektronic Bill

> can it be done using C language ?

Code: Select all | Expand

#include <stdio.h>

#include <stdlib.h>

#include <string.h>

#include <poppler.h>

#include <libxml/parser.h>

#include <libxml/tree.h>

#define MAX_PATH 1024

void embed_xml_in_pdf(const char* pdf_path, const char* xml_path, const char* output_path) {

PopplerDocument *doc;

GError *error = NULL;

char *xml_content;

gsize xml_length;

// Load the PDF

doc = poppler_document_new_from_file(pdf_path, NULL, &error);

if (!doc) {

fprintf(stderr, "Error loading PDF: %s\n", error->message);

g_error_free(error);

return;

}

// Read the XML file

if (!g_file_get_contents(xml_path, &xml_content, &xml_length, &error)) {

fprintf(stderr, "Error reading XML file: %s\n", error->message);

g_error_free(error);

g_object_unref(doc);

return;

}

// Embed the XML

if (!poppler_document_embed_file(doc, xml_path, xml_content, xml_length, NULL, &error)) {

fprintf(stderr, "Error embedding XML: %s\n", error->message);

g_error_free(error);

} else {

printf("XML embedded successfully.\n");

}

// Save the PDF

if (!poppler_document_save(doc, output_path, &error)) {

fprintf(stderr, "Error saving PDF: %s\n", error->message);

g_error_free(error);

} else {

printf("PDF saved successfully.\n");

}

g_free(xml_content);

g_object_unref(doc);

}

void extract_xml_from_pdf(const char* pdf_path) {

PopplerDocument *doc;

GError *error = NULL;

GList *attachments, *l;

// Load the PDF

doc = poppler_document_new_from_file(pdf_path, NULL, &error);

if (!doc) {

fprintf(stderr, "Error loading PDF: %s\n", error->message);

g_error_free(error);

return;

}

// Get attachments

attachments = poppler_document_get_attachments(doc);

for (l = attachments; l; l = l->next) {

PopplerAttachment *attachment = (PopplerAttachment *)l->data;

if (g_str_has_suffix(attachment->name, ".xml")) {

gchar *xml_content;

gsize xml_length;

if (poppler_attachment_save(attachment, &xml_content, &xml_length, &error)) {

// Parse XML

xmlDocPtr doc = xmlReadMemory(xml_content, xml_length, NULL, NULL, 0);

if (doc != NULL) {

xmlChar *xmlbuff;

int buffersize;

xmlDocDumpFormatMemory(doc, &xmlbuff, &buffersize, 1);

printf("Extracted XML:\n%s\n", (char *)xmlbuff);

xmlFree(xmlbuff);

xmlFreeDoc(doc);

} else {

fprintf(stderr, "Error parsing XML\n");

}

g_free(xml_content);

} else {

fprintf(stderr, "Error extracting XML: %s\n", error->message);

g_error_free(error);

}

}

}

g_list_free_full(attachments, (GDestroyNotify)g_object_unref);

g_object_unref(doc);

}

int main() {

const char *pdf_path = "input.pdf";

const char *xml_path = "invoice.xml";

const char *output_path = "output_with_xml.pdf";

embed_xml_in_pdf(pdf_path, xml_path, output_path);

extract_xml_from_pdf(output_path);

return 0;

}- Antonio Linares

- Site Admin

- Posts: 42268

- Joined: Thu Oct 06, 2005 5:47 pm

- Location: Spain

- Contact:

Re: Europen Elektronic Bill

Using Python:

Code: Select all | Expand

import io

from PyPDF2 import PdfReader, PdfWriter

from lxml import etree

def embed_xml_in_pdf(pdf_path, xml_path, output_path):

# Read the existing PDF

reader = PdfReader(pdf_path)

writer = PdfWriter()

# Copy pages from reader to writer

for page in reader.pages:

writer.add_page(page)

# Read the XML file

with open(xml_path, 'rb') as xml_file:

xml_content = xml_file.read()

# Add the XML as an embedded file

writer.add_attachment(xml_path, xml_content)

# Write the output PDF

with open(output_path, 'wb') as output_file:

writer.write(output_file)

def extract_xml_from_pdf(pdf_path):

reader = PdfReader(pdf_path)

# Get the embedded files

embedded_files = reader.attachments

for filename, content in embedded_files.items():

if filename.endswith('.xml'):

# Parse the XML content

root = etree.fromstring(content)

# You can now work with the XML data

print(etree.tostring(root, pretty_print=True).decode())

# Usage

embed_xml_in_pdf('input.pdf', 'invoice.xml', 'output_with_xml.pdf')

extract_xml_from_pdf('output_with_xml.pdf')Re: Europen Elektronic Bill

hi Otto,

i have no Idea about XML File.

there seems to be a WebSite which can create it online

https://xrechnung-erstellen.com/

i have just the Information which i have read in Germen Xbase++ Forum about ZUFERD or X-RECHNUNG.Otto wrote:can you post some basic information here?

i have no Idea about XML File.

there seems to be a WebSite which can create it online

https://xrechnung-erstellen.com/

greeting,

Jimmy

Jimmy

Re: Europen Elektronic Bill

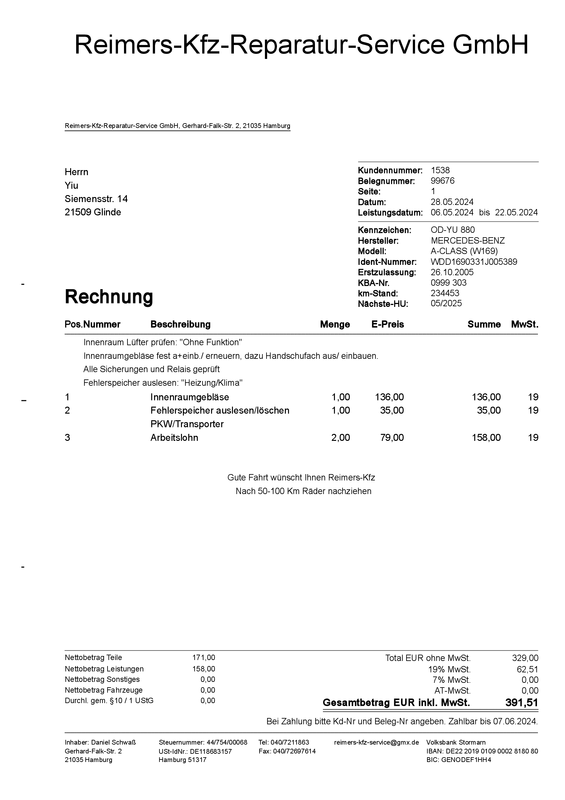

hi,

i have this Bill

which include a File called Factur-X.XML and have this Context

i have this Bill

which include a File called Factur-X.XML and have this Context

i use SUMATRAPDF v3.1.2 to show PDF an extract include *.XML File<?xml version="1.0" encoding="UTF-8"?>

<rsm:CrossIndustryInvoice xmlns:a="urn:un:unece:uncefact:data:standard:QualifiedDataType:100" xmlns:rsm="urn:un:unece:uncefact:data:standard:CrossIndustryInvoice:100" xmlns:qdt="urn:un:unece:uncefact:data:standard:QualifiedDataType:10" xmlns:ram="urn:un:unece:uncefact:data:standard:ReusableAggregateBusinessInformationEntity:100" xmlns:xs="http://www.w3.org/2001/XMLSchema" xmlns:udt="urn:un:unece:uncefact:data:standard:UnqualifiedDataType:100">

<rsm:ExchangedDocumentContext>

<ram:GuidelineSpecifiedDocumentContextParameter>

<ram:ID>urn:cen.eu:en16931:2017#compliant#urn:xoev-de:kosit:standard:xrechnung_2.2</ram:ID>

</ram:GuidelineSpecifiedDocumentContextParameter>

</rsm:ExchangedDocumentContext>

<rsm:ExchangedDocument>

<ram:ID>99676</ram:ID>

<ram:TypeCode>380</ram:TypeCode>

<ram:IssueDateTime>

<udt:DateTimeString format="102">20240528</udt:DateTimeString>

</ram:IssueDateTime>

</rsm:ExchangedDocument>

<rsm:SupplyChainTradeTransaction>

<ram:IncludedSupplyChainTradeLineItem>

<ram:AssociatedDocumentLineDocument>

<ram:LineID>1</ram:LineID>

</ram:AssociatedDocumentLineDocument>

<ram:SpecifiedTradeProduct>

<ram:SellerAssignedID>32515.00860</ram:SellerAssignedID>

<ram:Name>Innenraumgebläse</ram:Name>

</ram:SpecifiedTradeProduct>

<ram:SpecifiedLineTradeAgreement>

<ram:NetPriceProductTradePrice>

<ram:ChargeAmount>136.00</ram:ChargeAmount>

</ram:NetPriceProductTradePrice>

</ram:SpecifiedLineTradeAgreement>

<ram:SpecifiedLineTradeDelivery>

<ram:BilledQuantity unitCode="H87">1.00</ram:BilledQuantity>

</ram:SpecifiedLineTradeDelivery>

<ram:SpecifiedLineTradeSettlement>

<ram:ApplicableTradeTax>

<ram:TypeCode>VAT</ram:TypeCode>

<ram:CategoryCode>S</ram:CategoryCode>

<ram:RateApplicablePercent>19.00</ram:RateApplicablePercent>

</ram:ApplicableTradeTax>

<ram:SpecifiedTradeSettlementLineMonetarySummation>

<ram:LineTotalAmount>136.00</ram:LineTotalAmount>

</ram:SpecifiedTradeSettlementLineMonetarySummation>

</ram:SpecifiedLineTradeSettlement>

</ram:IncludedSupplyChainTradeLineItem>

<ram:IncludedSupplyChainTradeLineItem>

<ram:AssociatedDocumentLineDocument>

<ram:LineID>2</ram:LineID>

</ram:AssociatedDocumentLineDocument>

<ram:SpecifiedTradeProduct>

<ram:SellerAssignedID>0</ram:SellerAssignedID>

<ram:Name>Fehlerspeicher auslesen/löschen PKW/Transporter</ram:Name>

</ram:SpecifiedTradeProduct>

<ram:SpecifiedLineTradeAgreement>

<ram:NetPriceProductTradePrice>

<ram:ChargeAmount>35.00</ram:ChargeAmount>

</ram:NetPriceProductTradePrice>

</ram:SpecifiedLineTradeAgreement>

<ram:SpecifiedLineTradeDelivery>

<ram:BilledQuantity unitCode="H87">1.00</ram:BilledQuantity>

</ram:SpecifiedLineTradeDelivery>

<ram:SpecifiedLineTradeSettlement>

<ram:ApplicableTradeTax>

<ram:TypeCode>VAT</ram:TypeCode>

<ram:CategoryCode>S</ram:CategoryCode>

<ram:RateApplicablePercent>19.00</ram:RateApplicablePercent>

</ram:ApplicableTradeTax>

<ram:SpecifiedTradeSettlementLineMonetarySummation>

<ram:LineTotalAmount>35.00</ram:LineTotalAmount>

</ram:SpecifiedTradeSettlementLineMonetarySummation>

</ram:SpecifiedLineTradeSettlement>

</ram:IncludedSupplyChainTradeLineItem>

<ram:IncludedSupplyChainTradeLineItem>

<ram:AssociatedDocumentLineDocument>

<ram:LineID>3</ram:LineID>

</ram:AssociatedDocumentLineDocument>

<ram:SpecifiedTradeProduct>

<ram:SellerAssignedID>1</ram:SellerAssignedID>

<ram:Name>Arbeitslohn</ram:Name>

</ram:SpecifiedTradeProduct>

<ram:SpecifiedLineTradeAgreement>

<ram:NetPriceProductTradePrice>

<ram:ChargeAmount>79.00</ram:ChargeAmount>

</ram:NetPriceProductTradePrice>

</ram:SpecifiedLineTradeAgreement>

<ram:SpecifiedLineTradeDelivery>

<ram:BilledQuantity unitCode="HUR">2.00</ram:BilledQuantity>

</ram:SpecifiedLineTradeDelivery>

<ram:SpecifiedLineTradeSettlement>

<ram:ApplicableTradeTax>

<ram:TypeCode>VAT</ram:TypeCode>

<ram:CategoryCode>S</ram:CategoryCode>

<ram:RateApplicablePercent>19.00</ram:RateApplicablePercent>

</ram:ApplicableTradeTax>

<ram:SpecifiedTradeSettlementLineMonetarySummation>

<ram:LineTotalAmount>158.00</ram:LineTotalAmount>

</ram:SpecifiedTradeSettlementLineMonetarySummation>

</ram:SpecifiedLineTradeSettlement>

</ram:IncludedSupplyChainTradeLineItem>

<ram:ApplicableHeaderTradeAgreement>

<ram:BuyerReference></ram:BuyerReference>

<ram:SellerTradeParty>

<ram:Name>Reimers-Kfz-Reparatur-Service GmbH</ram:Name>

<ram:DefinedTradeContact>

<ram:PersonName>Daniel Schwaß</ram:PersonName>

<ram:TelephoneUniversalCommunication>

<ram:CompleteNumber>040/7211863</ram:CompleteNumber>

</ram:TelephoneUniversalCommunication>

<ram:EmailURIUniversalCommunication>

<ram:URIID>reimers-kfz-service@gmx.de</ram:URIID>

</ram:EmailURIUniversalCommunication>

</ram:DefinedTradeContact>

<ram:PostalTradeAddress>

<ram:PostcodeCode>21035</ram:PostcodeCode>

<ram:LineOne>Gerhard-Falk-Str. 2</ram:LineOne>

<ram:CityName>Hamburg</ram:CityName>

<ram:CountryID>DE</ram:CountryID>

</ram:PostalTradeAddress>

<ram:SpecifiedTaxRegistration>

<ram:ID schemeID="FC">44/754/00068</ram:ID>

</ram:SpecifiedTaxRegistration>

<ram:SpecifiedTaxRegistration>

<ram:ID schemeID="VA">DE118683157</ram:ID>

</ram:SpecifiedTaxRegistration>

</ram:SellerTradeParty>

<ram:BuyerTradeParty>

<ram:ID>1538</ram:ID>

<ram:Name>Yiu</ram:Name>

<ram:DefinedTradeContact>

<ram:PersonName></ram:PersonName>

<ram:TelephoneUniversalCommunication>

<ram:CompleteNumber>Fr. Yiu 01718118882</ram:CompleteNumber>

</ram:TelephoneUniversalCommunication>

<ram:EmailURIUniversalCommunication>

<ram:URIID>yiuimex@t-online.de</ram:URIID>

</ram:EmailURIUniversalCommunication>

</ram:DefinedTradeContact>

<ram:PostalTradeAddress>

<ram:PostcodeCode>21509</ram:PostcodeCode>

<ram:LineOne>Siemensstr. 14</ram:LineOne>

<ram:CityName>Glinde</ram:CityName>

<ram:CountryID>DE</ram:CountryID>

</ram:PostalTradeAddress>

</ram:BuyerTradeParty>

<!-- pdffile -->

</ram:ApplicableHeaderTradeAgreement>

<ram:ApplicableHeaderTradeDelivery>

<ram:ActualDeliverySupplyChainEvent>

<ram:OccurrenceDateTime>

<udt:DateTimeString format="102">20240522</udt:DateTimeString>

</ram:OccurrenceDateTime>

</ram:ActualDeliverySupplyChainEvent>

</ram:ApplicableHeaderTradeDelivery>

<ram:ApplicableHeaderTradeSettlement>

<!-- creditor -->

<ram:InvoiceCurrencyCode>EUR</ram:InvoiceCurrencyCode>

<ram:SpecifiedTradeSettlementPaymentMeans>

<ram:TypeCode>1</ram:TypeCode>

<!-- iban -->

</ram:SpecifiedTradeSettlementPaymentMeans>

<ram:ApplicableTradeTax>

<ram:CalculatedAmount>62.51</ram:CalculatedAmount>

<ram:TypeCode>VAT</ram:TypeCode>

<ram:BasisAmount>329.00</ram:BasisAmount>

<ram:CategoryCode>S</ram:CategoryCode>

<ram:RateApplicablePercent>19.00</ram:RateApplicablePercent>

</ram:ApplicableTradeTax>

<ram:SpecifiedTradePaymentTerms>

<ram:Description>Bei Zahlung bitte Kd-Nr und Beleg-Nr angeben. Zahlbar bis 07.06.2024.</ram:Description>

<!-- debitor -->

</ram:SpecifiedTradePaymentTerms>

<ram:SpecifiedTradeSettlementHeaderMonetarySummation>

<ram:LineTotalAmount>329.00</ram:LineTotalAmount>

<ram:TaxBasisTotalAmount>329.00</ram:TaxBasisTotalAmount>

<ram:TaxTotalAmount currencyID="EUR">62.51</ram:TaxTotalAmount>

<ram:GrandTotalAmount>391.51</ram:GrandTotalAmount>

<ram:DuePayableAmount>391.51</ram:DuePayableAmount>

</ram:SpecifiedTradeSettlementHeaderMonetarySummation>

</ram:ApplicableHeaderTradeSettlement>

</rsm:SupplyChainTradeTransaction>

</rsm:CrossIndustryInvoice>

greeting,

Jimmy

Jimmy

Re: Europen Elektronic Bill

hi Antonio,

THX for Sample, but i have no Idea how to use it with FivewinAntonio Linares wrote:Using Python:

greeting,

Jimmy

Jimmy

- Marc Venken

- Posts: 1481

- Joined: Tue Jun 14, 2016 7:51 am

- Location: Belgium

Re: Europen Elektronic Bill

In Belgium we also have to deal with "PEPPOL". A way of sending and validating the XML files for invoicing to the gouvernement etc.. Business will also more and more request peppol use for transactions.Jimmy wrote:hi Otto,i have just the Information which i have read in Germen Xbase++ Forum about ZUFERD or X-RECHNUNG.Otto wrote:can you post some basic information here?

i have no Idea about XML File.

there seems to be a WebSite which can create it online

https://xrechnung-erstellen.com/

They have a site and also sample xml files to review. I also plan to create the xml files because the deadline here is 2026.

Marc Venken

Using: FWH 23.08 with Harbour

Using: FWH 23.08 with Harbour

- Silvio.Falconi

- Posts: 7104

- Joined: Thu Oct 18, 2012 7:17 pm

Re: Europen Elektronic Bill

in Italy electronic invoicing has existed for years, they have practically inserted the invoice in all its forms in an xlm file but this needs another file where the style is stored, generally two types of style are associated, one such as a small page with all the data and an invoice type in graphic format. I started making a class to create electronic invoicing but then I didn't continue it due to family problems, on GitHub there are many examples also in c++(cs) or VB.

I didn't continue also because no one is interested and the fwh users are from different countries where electronic invoicing is very different, the Italians who in my opinion are the only ones who could help me were careful not to help me, but it could have been done something unique, I know that there is data stored in the invoice which can be different from one application to another but in Italy the government has imposed particular tables with particular codes, VAT rates, types of payment and many other tables.

I didn't continue also because no one is interested and the fwh users are from different countries where electronic invoicing is very different, the Italians who in my opinion are the only ones who could help me were careful not to help me, but it could have been done something unique, I know that there is data stored in the invoice which can be different from one application to another but in Italy the government has imposed particular tables with particular codes, VAT rates, types of payment and many other tables.

Since from 1991/1992 ( fw for clipper Rel. 14.4 - Momos)

I use : FiveWin for Harbour November 2023 - January 2024 - Harbour 3.2.0dev (harbour_bcc770_32_20240309) - Bcc7.70 - xMate ver. 1.15.3 - PellesC - mail: silvio[dot]falconi[at]gmail[dot]com

I use : FiveWin for Harbour November 2023 - January 2024 - Harbour 3.2.0dev (harbour_bcc770_32_20240309) - Bcc7.70 - xMate ver. 1.15.3 - PellesC - mail: silvio[dot]falconi[at]gmail[dot]com

- Marc Venken

- Posts: 1481

- Joined: Tue Jun 14, 2016 7:51 am

- Location: Belgium

Re: Europen Elektronic Bill

Every countrie will use the basis EU-part for the data and supplement for eacht there own items like Silvio says.

There is a list for the EU- codes and a list for the syntax codes. I found part of it and ChatGPT provided some extra info about it.

Some info (since it is from the Peppol site will be more related to Belgium, but part will be usefull.

Home location of info

https://docs.peppol.eu/poacc/billing/3.0/

The Billing data list

https://docs.peppol.eu/poacc/billing/3. ... oice/tree/

There is also a BT ... list that need to be used and for us, a code that relates to that BT List

Sample :

BT-1: Invoice number

Syntaxelement: <cbc:ID>

BT-2: Invoice issue date

Syntaxelement: <cbc:IssueDate>

BT-3: Invoice type code

Syntaxelement: <cbc:InvoiceTypeCode>

BT-5: Invoice currency code

Syntaxelement: <cbc:DocumentCurrencyCode>

BT-6: VAT accounting currency code

Syntaxelement: <cbc:TaxCurrencyCode>

BT-7: Value Added Tax point date

Syntaxelement: <cbc:TaxPointDate>

BT-9: Payment due date

Once we create a XML file from these codes, we will have a working invoice XML.

In my case I'm thinking of using a dbf with Xbrowse to keep the codes in and generate a xml on these.

<!-- Factuur informatie -->

<cbc:ID>12345</cbc:ID> <!-- BT-1: Invoice number -->

<cbc:IssueDate>2023-07-15</cbc:IssueDate> <!-- BT-2: Invoice issue date -->

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode> <!-- BT-3: Invoice type code -->

<cbc:DocumentCurrencyCode>EUR</cbc:DocumentCurrencyCode> <!-- BT-5: Invoice currency code -->

<cbc:DueDate>2023-08-15</cbc:DueDate> <!-- BT-9: Payment due date -->

In Setting dbf, i make 3 fields like : ID, Starttxt, Endtxt like : BT-1 , "<cbc:ID>", "</cbc:ID>"

and in the program I link the data to BT-1 = data->invoice etc....

<cbc:ID>BT-1</cbc:ID>

<cbc:IssueDate>BT-2</cbc:IssueDate>

<cbc:InvoiceTypeCode>BT-3</cbc:InvoiceTypeCode>

<cbc:Note>BT-4</cbc:Note>

<cbc:DocumentCurrencyCode>BT-5</cbc:DocumentCurrencyCode>

Some of you will be using textinto or FWrite not ??

There is a list for the EU- codes and a list for the syntax codes. I found part of it and ChatGPT provided some extra info about it.

Some info (since it is from the Peppol site will be more related to Belgium, but part will be usefull.

Home location of info

https://docs.peppol.eu/poacc/billing/3.0/

The Billing data list

https://docs.peppol.eu/poacc/billing/3. ... oice/tree/

There is also a BT ... list that need to be used and for us, a code that relates to that BT List

Sample :

BT-1: Invoice number

Syntaxelement: <cbc:ID>

BT-2: Invoice issue date

Syntaxelement: <cbc:IssueDate>

BT-3: Invoice type code

Syntaxelement: <cbc:InvoiceTypeCode>

BT-5: Invoice currency code

Syntaxelement: <cbc:DocumentCurrencyCode>

BT-6: VAT accounting currency code

Syntaxelement: <cbc:TaxCurrencyCode>

BT-7: Value Added Tax point date

Syntaxelement: <cbc:TaxPointDate>

BT-9: Payment due date

Once we create a XML file from these codes, we will have a working invoice XML.

In my case I'm thinking of using a dbf with Xbrowse to keep the codes in and generate a xml on these.

<!-- Factuur informatie -->

<cbc:ID>12345</cbc:ID> <!-- BT-1: Invoice number -->

<cbc:IssueDate>2023-07-15</cbc:IssueDate> <!-- BT-2: Invoice issue date -->

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode> <!-- BT-3: Invoice type code -->

<cbc:DocumentCurrencyCode>EUR</cbc:DocumentCurrencyCode> <!-- BT-5: Invoice currency code -->

<cbc:DueDate>2023-08-15</cbc:DueDate> <!-- BT-9: Payment due date -->

In Setting dbf, i make 3 fields like : ID, Starttxt, Endtxt like : BT-1 , "<cbc:ID>", "</cbc:ID>"

and in the program I link the data to BT-1 = data->invoice etc....

<cbc:ID>BT-1</cbc:ID>

<cbc:IssueDate>BT-2</cbc:IssueDate>

<cbc:InvoiceTypeCode>BT-3</cbc:InvoiceTypeCode>

<cbc:Note>BT-4</cbc:Note>

<cbc:DocumentCurrencyCode>BT-5</cbc:DocumentCurrencyCode>

Some of you will be using textinto or FWrite not ??

Marc Venken

Using: FWH 23.08 with Harbour

Using: FWH 23.08 with Harbour

- Marc Venken

- Posts: 1481

- Joined: Tue Jun 14, 2016 7:51 am

- Location: Belgium

Re: Europen Elektronic Bill

Most likely it will be a good idea to keep some xml invoices that all of us already receive from parties that have made the transition to xml and pdf.

These we can that use (copy the used codes) and base our program on them.

These samples I have are for 95% identical (not the specific invoice detail ))))), so it should not be to complex, once base my layout on them.

These we can that use (copy the used codes) and base our program on them.

These samples I have are for 95% identical (not the specific invoice detail ))))), so it should not be to complex, once base my layout on them.

Marc Venken

Using: FWH 23.08 with Harbour

Using: FWH 23.08 with Harbour

Re: Europen Elektronic Bill

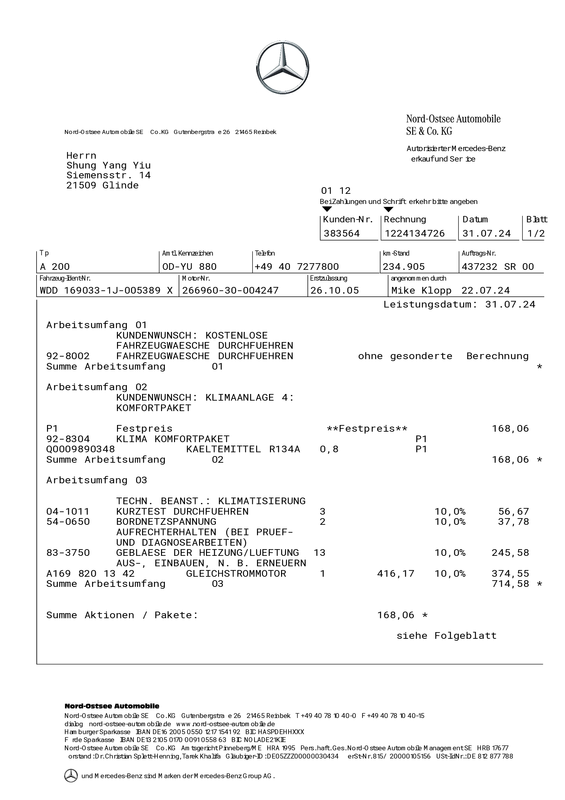

hi,

here another Sample

Good Ideas.Marc Venken wrote:Most likely it will be a good idea to keep some xml invoices that all of us already receive from parties that have made the transition to xml and pdf.

These we can that use (copy the used codes) and base our program on them.

here another Sample

Code: Select all | Expand

<?xml version="1.0" encoding="UTF-8" ?>

<rsm:CrossIndustryDocument xmlns:rsm="urn:ferd:CrossIndustryDocument:invoice:1p0" xmlns:ram="urn:un:unece:uncefact:data:standard:ReusableAggregateBusinessInformationEntity:12" xmlns:udt="urn:un:unece:uncefact:data:standard:UnqualifiedDataType:15">

<rsm:SpecifiedExchangedDocumentContext>

<ram:GuidelineSpecifiedDocumentContextParameter>

<ram:ID>urn:ferd:CrossIndustryDocument:invoice:1p0:basic</ram:ID>

</ram:GuidelineSpecifiedDocumentContextParameter>

</rsm:SpecifiedExchangedDocumentContext>

<rsm:HeaderExchangedDocument>

<ram:ID>1224134726</ram:ID>

<ram:Name>Rechnung</ram:Name>

<ram:TypeCode>380</ram:TypeCode>

<ram:IssueDateTime>

<udt:DateTimeString format="102">20240731</udt:DateTimeString>

</ram:IssueDateTime>

<ram:IncludedNote>

<ram:Content>identNummer:WDD1690331J005389X</ram:Content>

</ram:IncludedNote>

</rsm:HeaderExchangedDocument>

<rsm:SpecifiedSupplyChainTradeTransaction>

<ram:ApplicableSupplyChainTradeAgreement>

<ram:SellerTradeParty>

<ram:Name>NORD-OSTSEE AUTOMOBILE</ram:Name>

<ram:PostalTradeAddress>

<ram:PostcodeCode>21465</ram:PostcodeCode>

<ram:LineOne>GUTENBERGSTRAßE 26</ram:LineOne>

<ram:CityName>REINBEK</ram:CityName>

<ram:CountryID>DE</ram:CountryID>

</ram:PostalTradeAddress>

<ram:SpecifiedTaxRegistration>

<ram:ID schemeID="VA">DE812877788</ram:ID>

</ram:SpecifiedTaxRegistration>

</ram:SellerTradeParty>

<ram:BuyerTradeParty>

<ram:ID>383564</ram:ID>

<ram:Name>Herrn Shung Yang Yiu</ram:Name>

<ram:PostalTradeAddress>

<ram:PostcodeCode>21509</ram:PostcodeCode>

<ram:LineOne>Siemensstr. 14</ram:LineOne>

<ram:CityName>Glinde</ram:CityName>

<ram:CountryID>DE</ram:CountryID>

</ram:PostalTradeAddress>

</ram:BuyerTradeParty>

</ram:ApplicableSupplyChainTradeAgreement>

<ram:ApplicableSupplyChainTradeDelivery>

<ram:ActualDeliverySupplyChainEvent>

<ram:OccurrenceDateTime>

<udt:DateTimeString format="102">20240731</udt:DateTimeString>

</ram:OccurrenceDateTime>

</ram:ActualDeliverySupplyChainEvent>

</ram:ApplicableSupplyChainTradeDelivery>

<ram:ApplicableSupplyChainTradeSettlement>

<ram:InvoiceCurrencyCode>EUR</ram:InvoiceCurrencyCode>

<ram:ApplicableTradeTax>

<ram:CalculatedAmount currencyID="EUR">167.70</ram:CalculatedAmount>

<ram:TypeCode>VAT</ram:TypeCode>

<ram:BasisAmount currencyID="EUR">882.64</ram:BasisAmount>

<ram:ApplicablePercent>19.00</ram:ApplicablePercent>

</ram:ApplicableTradeTax>

<ram:SpecifiedTradeSettlementMonetarySummation>

<ram:LineTotalAmount currencyID="EUR">882.64</ram:LineTotalAmount>

<ram:ChargeTotalAmount currencyID="EUR">0.00</ram:ChargeTotalAmount>

<ram:AllowanceTotalAmount currencyID="EUR">0.00</ram:AllowanceTotalAmount>

<ram:TaxBasisTotalAmount currencyID="EUR">882.64</ram:TaxBasisTotalAmount>

<ram:TaxTotalAmount currencyID="EUR">167.70</ram:TaxTotalAmount>

<ram:GrandTotalAmount currencyID="EUR">1050.34</ram:GrandTotalAmount>

</ram:SpecifiedTradeSettlementMonetarySummation>

</ram:ApplicableSupplyChainTradeSettlement>

</rsm:SpecifiedSupplyChainTradeTransaction>

</rsm:CrossIndustryDocument>greeting,

Jimmy

Jimmy